- The Crypto Bootcamp

- Posts

- What Coin Should I Buy?

What Coin Should I Buy?

Finding the right coin to buy is hard. It's also the wrong question to ask. Becoming a good crypto investor isn't hard. Just follow this simple method...

Hey, it’s Kesh 👋

I can’t tell you how often people ask me “what coin should I buy?” and every time I have to give them an answer I know they won’t like.

But I don’t blame them, crypto is super complicated and there’s nowhere to find a good analogy to make sense of things. That’s why I started The Crypto Bootcamp.

Ok, let’s address the problem head-on. The “what coin should I buy” is the wrong question to ask.

What you should be asking is “WHY should I own this coin?”

After all, why would you buy Amazon stock? Or Apple stock?

For me, it’s not a complicated decision (you shouldn’t overcomplicate it either).

It boils down to:

Do I USE their products?

Is it a good brand?

Do I think the company will grow?

Do I want to own a piece of that company?

That’s it. That’s all it takes for me to decide if I want to buy the stock.

Now let’s apply that same logic to Crypto.

Ask yourself these questions the next time you see a hot new coin:

Can I use it as a currency?

How does it work?

What is the circulating supply vs maximum supply?

Why THIS coin versus another similar coin?

The first thing I do is go to coinmarketcap.com and find the coin I’m looking for. Let’s go with Bitcoin for this example.

Can I Use it As a Currency?

Bitcoin has established itself as a currency.

How do we know this? Because people will accept it for goods and services. That’s all it takes. It sounds simple but for 99% of cryptocurrencies out there, it won’t work.

Just ask someone if they would take their salary in Shiba Inu coin (probably not).

How Does it Work?

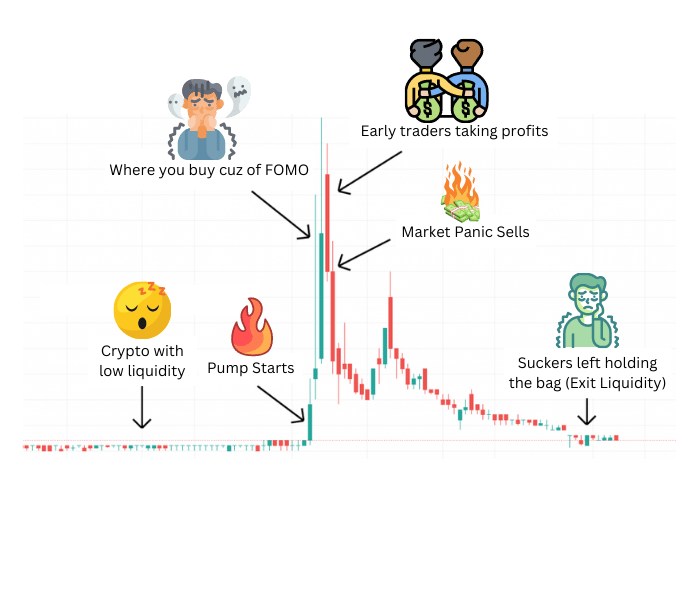

Most people will buy a coin just because they heard “number go up”. But if you don’t know how it works, you’re known as “exit liquidity.”

Don’t take someone else’s word for it. Read the whitepaper and understand their incentive structure. We’ll cover how to do that in a later edition.

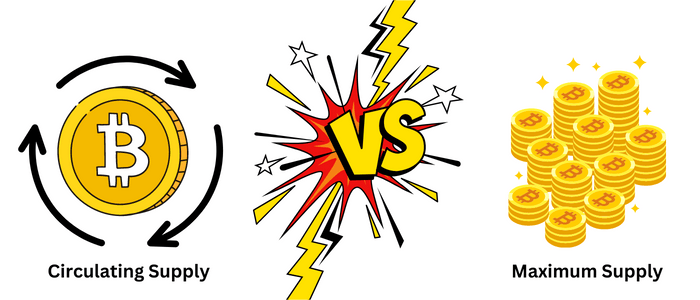

Circulating Supply vs Max Supply

As of now, bitcoin only has about 19.3 million coins in circulation with a max supply of 21 million. Knowing these numbers is really important. Why? because it’s the #1 way your investment can quickly go to zero.

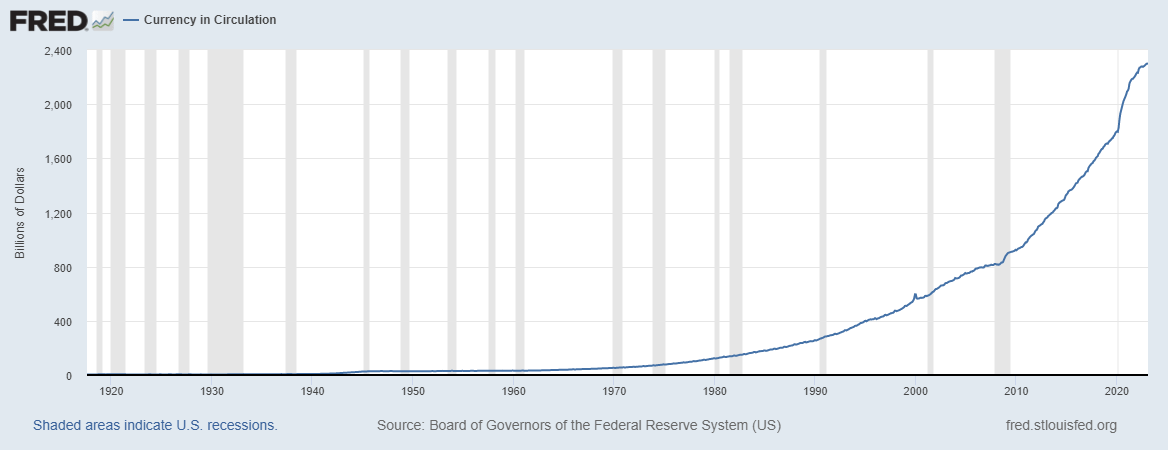

Look at this graph showing the number of dollars in circulation since the 1920s. That’s in billions of dollars!

Circulating Supply of USD (1920-2022)

Let’s say there were 1 billion dollars in circulation in 1920. If you had 1 million dollars in your bank account, you would control 0.1% of all the USD in circulation.

Now let’s say you took a time machine to 2020 (2.3 trillion max supply). That 1 million dollars is still in your account, but now it only makes up 0.000043% of the circulating supply.

You have the same amount of money but the VALUE of that money was decreased exponentially. A dollar can’t buy what it used to.

That’s what happens when more USD is printed. It’s the same with crypto.

Money printer go Brrrrr

If you own 1 bitcoin today, you can only get diluted by a limited amount. Why? Because there are 19.3 million BTC in circulation and the max supply is 21 million. We can’t create any more bitcoin after we hit the 21 million cap.

So when you compare the VALUE of BTC vs USD, bitcoin will get more and more expensive. (because USD is getting less valuable).

Why THIS coin specifically?

Crypto is open source. Which means anyone can create a cryptocurrency. What most people do is reserve 10% (some take more) of the TOTAL supply for themselves. This supply is usually locked for a few years with it gradually unlocking over a 4 year period.

A coin getting unlocked is the same as the US Gov’t printing more USD.

But every project and team is different. And not everyone is honest about the unlock schedule. That’s why it’s so important to DYOR - Do Your Own Research.

How do you DYOR?

You’re doing it now. You’re learning how this whole system works, which is the first step in becoming a smarter investor. Ok here are some tactical tips for you to quickly see if a coin is worth it:

Coin Distribution: Is the distribution of coins decentralized? Specifically, you want to see if the currency is spread out amongst its users or if 2-3 people own 50% of the supply.

Max Supply: Is there an unlimited maximum supply? This isn’t an automatic red flag but it’s important to note.

If there is an unlimited supply, is there a mechanism to remove coins from circulation?

Audits: Is the project audited? Look on their official website and check for audit badges. If they did an audit, they will display it on their website as a badge of credibility (it will be obvious).

Predatory VCs: Is it funded by venture capitalists? If so, they will most likely sell as soon as their coins unlock. In this case, you have to be like Uncle Warren:

That's all for this week.

If you're not getting value out of this newsletter, please share it with one person that would benefit from it.

See you again next week.

Thanks,

Kesh